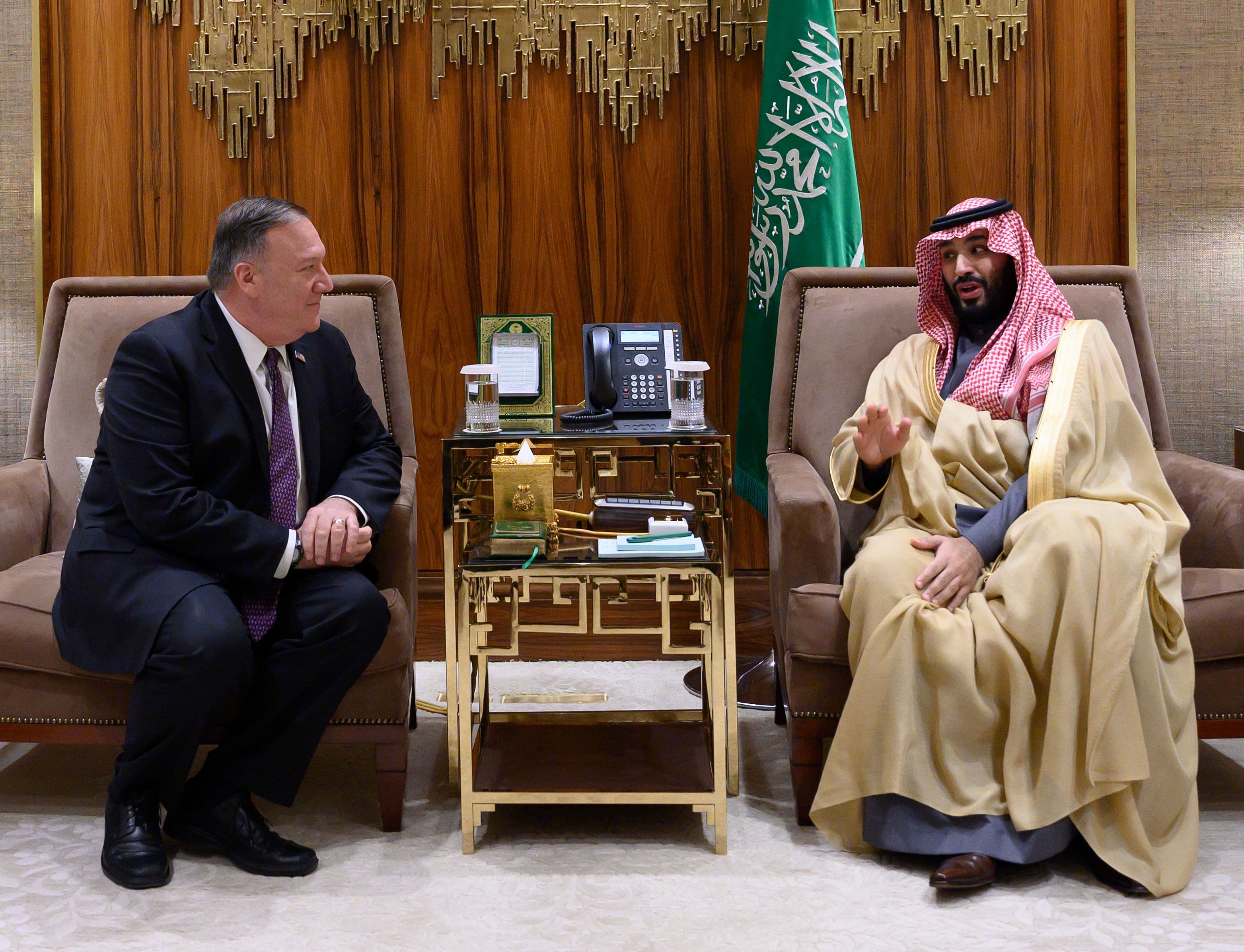

There are still people around who believe that the Saudi action of signalling a massive supply boost to the market and causing the crash in crude prices was the result of a breaking price war with Russia. Mike Pompeo seems to be one of them, or at least so he said so when he implored Mohammed bin Salman to end the perceived conflict and bring prices back up. Obviously, the pressure is growing on the domestic shale industry that can hardly survive on below 30 dollars per barrel.

Even Donald Trump who hailed the price drop as a boon for America consumers has come around to realise that a material constituency of his re-election chances is all of a sudden fighting for survival. To be sure, Salman would not have pushed the domino over without filling the White House or Trump personally in, but he probably sold it as a joint US-Saudi measure to weaken the bedrock of Russia’s economy. Little did Trump know what the real reason was.

It must have dawned on everyone by now that Salman’s move was a concealed operation targeting not Russian but US shale producers. They had thrived on the efforts of OPEC+ to keep prices elevated. The collusion of Moscow and Riyadh to control output over the past 2 years has been the foundation of the US industry in the first place. The Saudis seem to be bent on to now break the unwanted competitor, over and above any visible short-term advantage to themselves or to Russia.

However, Riyadh is the lowest cost operator in the field, has the longest breath of all producers, and can sit this out longer than anyone else. Of course, there is the issue of the unsustainable budget deficit, but to be top of the brass in the sector is fundamentally more important. And Russia has a well functioning mechanism to more or less link its currency to the oil price and largely keep Ruble-denominated revenues constant, no matter where crude trades on the world markets.

The most exposed protagonists in this space are American shale companies. They are highly levered entities vulnerable to any changes in the market environment and particularly when prices drop as hard as we have witnessed and below their cost of production. As in 2016, the debt will crush many of them, and swaths of the domestic sector will go out of business. Combine this with the worsening health crisis and the ensuing demand destruction, and they have armageddon cut out for themselves.

Well, despite the media coverage of Pompeo pleading with Salman to “rise up to the occasion” he will not have asked nicely, and there is leverage that Washington can bring to the table. As Trump has literally threatened the king once before, that Saudi Arabia would not survive two weeks without the power of the US military, America will not just let this slide, especially not in an election year. But what can they do to bring the crown prince in line? He has proven to be an unrelenting leader.

Well, many of you might remember a piece of US legislation that I have commented on in a

post over a year ago. The NOPEC Act of early 2019 is a bill passed by the House Judiciary Committee that would allow the US justice department to sue members of OPEC including Saudi Arabia over manipulating the crude price. The bill was named No Oil Producing and Exporting Cartels Act, or NOPEC, in an apparent attempt to add some dubious humour to the move.

The key to NOPEC is that Washington could remove the sovereign immunity of OPEC members and thereby expose them to US antitrust regulation. It is not the first time that such an initiative has been tabled, but previous presidents refrained from taking action predominantly to protect the US-Saudi alliance. Ironically, Trump re-introduced it last year on the basis that oil prices were too high and the benefits to his shale producers were outweighed by the relative damage done to the economy.

Now, the low oil price may be a boon to the soon-to-be-ailing US economy, but a good portion of America’s shale industry will either go bust or capital expenditure pulled back to an extent that will bring the sector at home to a grinding halt. No president can have that, particularly when he is fighting on all fronts. Pompeo’s role in the call with Salman was likely to be that of a fixer, as in making sure the crown prince understood he needs to dance to the American tunes, or else…

If NOPEC were to be enacted, and Trump could quickly force the bill through Congress, it would allow for the Saudis to be sued under existing antitrust legislation in US courts. You know what this potentially means…? Freezing Saudi assets and bank accounts, putting a risk a total value of roundabout a trillion dollars, and halting the use of dollars by Riyadh anywhere in the world. Moreover, Aramco could be ordered to be broken up to comply with US competition rules and prevent it to influence the oil price.

So, we know what either side wants with Russia standing idly by, maybe even smirkingly, but the real question comes down to who blinks first, and is the American stick long enough to impress on Salman? A lot is at stake, and you will have to make a bet on who wins this match and deduct from that where crude will turn in the coming days and weeks.