Good morning, Asia…! This is your regular curve watch, rate curve that is. As this space has not tired to point out across past weeks, the state of the US economy may not be as well as is reported in the mainstream media. Amid their jubilations, the pundits seem to have forgotten the one red flag that is the most important indicator of an impending economic well-being or malaise.

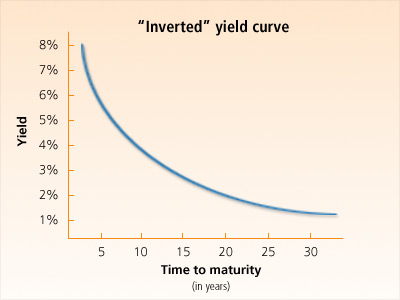

The long end of the Treasury yield curve has stubbornly held around the 2.30-2.40% in 10 years and 2.70-2.80% in 30 years recently. Yields haven’t yet fallen further as envisaged, but no rush, they will eventually. In the meantime, a different phenomenon has taken hold sooner than expected, and that is the rapid and accelerating flattening of the yield curve. We should all know from Econ 101 what this means, ie potentially troublesome times ahead.

It is caused by the ambitious rise in short rates. Observe that 2-year yields have spiraled up by a whopping 50bp in only 3 months, to 1.77% now. It is a testament that the market still buys the gradual rate rise theory of one Janet Yellen who will leave the Fed in February. The December hike is a foregone conclusion. In only 4 weeks it has flattened the 2/10 year curve by 25bp! We have now fallen back to 58.5bp, a reading last observed in 2007.

Maybe the 2 year part of the curve had some catching up to do. Libor had long preempted this development, creeping up by over 100bp in the past 24 months. The 1-month rate has recently commenced another leg up and is fast zooming in on 1.30%. The spread between the 2 year Treasury yield and Libor has now widened back to the 5 year average of 40-50bp, but only in September they were trading at the same level.

When we talk about interest rates and the effect on the business world, Libor has long preempted the trend on the short-end. As we all know, the majority of financings in our economies is based on Libor in any case, ie enterprises would have felt the brunt of higher rates in those past 24 months when money became more expensive by 100bp just on the reference rate.

The buoyant behaviour of this quintessential rate indicates more pressure to come. We already witness this in the leverage-dependent energy and resource space, but it is destined to seep through into other sectors. We’d be fools not to view the growth outlook in this context. The continuous catching up of the Treasury reference rate will amplify the effect. The economy must really run on all cylinders to stomach this going into 2018.

The second point about the curve to be made is the persistent lack of inflation. Last week the Bureau of Labor Statistics presented CPI numbers for October, and core inflation was still below the 2% target, at +1.8%. But how is inflation supposed to rise to the Fed’s comfort level, if the people in the ivory tower do not bother considering structural effects such as technology and its impact on labour costs.

In October, real wages in the US climbed by +0.4%, again far below the long-term average. Compared to previous months the numbers were negative for the third consecutive time. I wonder whether Jerome Powell as a non-economist understands better than his peers that the economic cyclicality of the economy is being disrupted by fundamental structural changes and limits the effects of our policies that we had become so accustomed to.

In any case, this lack of inflation has kept and will keep the long end in check for longer. The resilience of 30-year yields makes this picture more convincing. And the 2/30 year curve has tumbled even further and now crashed through 100bp, from 400bp at the peak in 2011 and 190bp earlier in the year. The momentum of this trend should be blatantly obvious to everybody now.

At this rate, it is possible that the yield curve either flattens entirely or even inverts in 2018. I remind of 10 years ago, when the curves had inverted in 2006 and most of 2007, as an introduction to the financial crisis and the biggest recession in modern times. Also remember that history tends to repeat itself, maybe in a different shape or form, but our levels of attention should long be raised by now.