Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

Worthwhile having a look at the Bank of Japan’s latest release of its February account. The consolidated balance sheet is obviously larger yet again by way of its uninterrupted purchase program of government bonds. From January, the total increased by 5.92 trillion Yen, or roughly 52 billion dollars, and year-on-year the additional amount is a whopping 84.1 trillion Yen, which comes to about 740 billion dollars.

We are all well aware that Japan has been maintaining their version of QE and printing money for decades, in different shapes and forms, and different quantities. From time to time however, it is reflective to remind ourselves of the sheer magnitude of what has been done. The most sizeable part of the BoJ operation is clearly attributable to the concept of currency debasement within Abenomics and the impact it has had over the past 4 years+.

Now hold your breath for a second. The current total balance sheet size of the Bank of Japan stands at 487.9 trillion Yen. In real money that is 4.3 trillion dollars, almost as much as the Fed’s current 4.5 trillion. Assuming the BoJ keeps printing at the speed of 50-60 billion dollars per month it will have caught up with the Fed’s balance sheet before summer – obviously only if the Fed recycles its Treasuries and doesn’t let them expire.

Also, we know that the Fed’s asset portfolio is half-way diverse, with only 2.5 trillion of the 4.5 being Treasury bills and bonds, or just over 50%, and 1.8 trillion of mortgage and other securities, that being 40%. The BoJ however sports an outright 420.9 trillion Yen of JGBs, or 86% of its total assets on balance. In absolute numbers the BoJ holds Japanese government bonds worth 3.7 trillion dollars, 1.2 trillion more than the Fed holds Treasuries.

This latest reading of holdings confirms that the BoJ is in possession of 38% of the entire JGB market, the share of which is destined to increase further. Some of the largest banks have retreated from acting as primary brokers. The market has become way too illiquid, trading volumes have collapsed, the only bid in town is literally the central bank, and there is simply no money to be made.

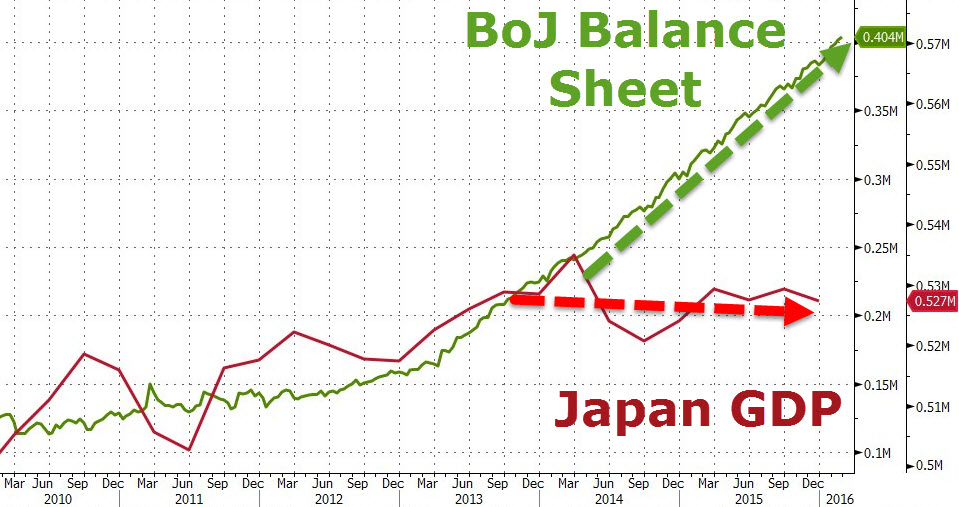

These numbers are even more staggering when you put them in context of the respective economies. The BoJ’s balance sheet may be as large as the Fed’s, but Japan’s nominal GDP is a quarter of the US’. America may have no reason to rejoice, but it at least has economic growth to speak of. Japan’s demographic trends will not allow any of the cyclical rebounds that Shinzo Abe and many of the pundits have been hoping for.

Since the financial crisis, when the BoJ maintained a balance sheet of only 100 trillion Yen, it has almost quintupled its asset base, pumping excess liquidity into the system in an unprecedented manner. However, banks have not been able to feed this money into the real economy, for the obvious demographic reasons. There are no multiplier effects to be had, and the velocity of money has remained floored.

It looks worse than any other of the world’s central bank’s conducts and their monetary policies. But is it…? Interesting to realise that over the past 15 years the multiple of the BoJ’s balance sheet increase has been lagging the Fed, the ECB, the PBoC and even the Swiss National Bank, when measured in their respective local currencies.

Since the 1990s Japan has always had more reasons than anyone else to adopt some form of quantitative easing, due to its predictably worsening societal structure and the ensuing economic and deflationary impacts. But the numbers also prove that others have been at least as crazy pushing into unchartered territory. If we believe nothing can save Japan, what about all the others…?

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.