This space had in the past pointed to the ludicrous mechanisms at the European Central Bank, where Christine Lagarde & Co have been printing money and pushing out excess liquidity like mad, and the commercial banking community would have none of it. Recent ECB reports show that banks’ negative-yielding deposits, by -50bp mind you, with the central bank have been north of 4 trillion Euros. The crew at the ivory tower may print however much they want and feel good about it, but no one wants their money.

One would have thought that this was a phenomenon confined to the Old Continent and a function of its sclerotic economies and the failed nature of the eurozone. But no… no such thing. As we witnessed in the course of this week, America’s money system seems to be suffering a similar fate. Mid-week, almost a trillion dollars were parked in the Fed’s reverse repo facility. To be sure, the daily balance has been volatile, but it was interesting that commercial banks’ deposits rose to record highs.

What happened…? The Fed in its slightly more hawkish statement in June made technical adjustments to two key facilities. One was the rate on excess reserves that banks are traditionally using with the Fed as a custodian for unused liquidity, and the other was the rate on reverse repos. They were both hiked by 5bp, from 10 to 15bp and zero to 5bp, respectively. Curiously, however, Treasury bills out to 6 months have been trading below the new repo rate of 5bp, ie 3-month bills hit 2bp on Tuesday.

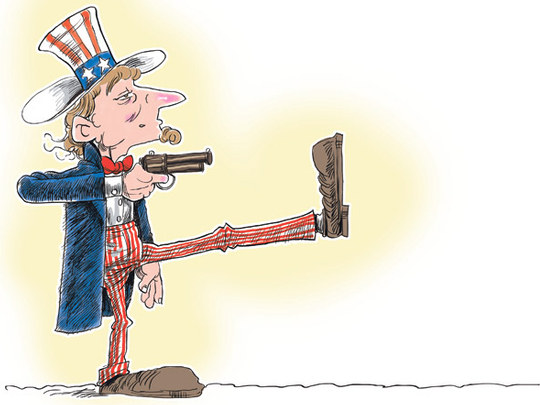

In other words, there is a sea of money market funds out there that have picked up on this dislocation and started rotating funds out of bills into the reverse repo at the Fed. And why not? What’s better than parking money at the country’s central bank and getting paid for it, even more so than in the Treasury market. However, it has the consequence that we are seeing the economy or at least the system being deprived of liquidity that the Fed is tirelessly creating.

As with the eurozone, it can hardly be in the eye of the beholder for a central bank to print gargantuan amounts of cash to support the financial system and the economic recovery, only for that cash to be returned to the Fed’s balance sheet in the form of deposits. At least American banks and money markets aren’t suffering from punitive returns as their yield is now positive, while their European counterparts have to take it on the chin to recycle the unwanted liquidity imposed on them.

The big question now is whether the dislocation will persist and potentially more rotation of this sort happen. It can easily turn into a devil’s circle, much like we had witnessed in late 2019, when the repo market also caused havoc for interbank financing and the Fed in turn had to come to the rescue by injecting even more liquidity into the system. So, if this were to become a trend and money market funds withdrawing funding for the banks to re-direct it to the Fed repo, another one of these bottlenecks may occur.

Any such dislocation is probably good for prices across asset classes, since eventually it only increases the money base in the system. And if the recovery wasn’t as sound as everyone wanted to believe, as pointed to in yesterday’s

post, more of the excess liquidity would continue to slosh around in the financial system and not reach the real economy as it should. While the hawks at the Fed ponder their next moves, they better be careful what they wish for.