It needs to be reiterated, over and over again. The central bank with the mother of all balance sheets is not the Federal Reserve, and neither is it long-term money printer Bank of Japan. No, it is the European Central Bank that leads the ranking. The most recent reading was catapulted to a new all-time value of 7.56 trillion Euros, not least by way of a record weekly increase of 36 billion. In dollar terms, the ECB is visibly leading the pack with in excess of 9 trillion, before the Fed with 7.82 and Japan with roughly 6.6 trillion.

At those new levels, the ECB balance sheet now stands at equal to 70.4% of the eurozone GDP versus the Fed’s 36.4%, so approx. double the ratio. And let’s not forget. Christine Lagarde is less hesitant in her QE craze than Jay Powell. Her diction is for more to come, and continuously so. The eurozone will get excess liquidity injections, whether it wants them or not. The imbalances across the Continent and the fall-off into the periphery prescribe such action, if not economically then politically.

If only Lagarde’s cash were to reach the real economy and had a positive effect. Size does matter occasionally, but sadly not in the case of the ECB balance sheet. It may be gargantuan at 7.56 trillion, but what does it matter if the aggressively allocated funds almost instantly u-turn and find their way back into the ECB. I have mentioned this numerous times before, most recently

here, but as the balance sheet size is going vertical, so are the commercial banks’ central bank deposits.

The most recent reading is 4.2 trillion, that is to say banks are parking excess liquidity that the ECB is imposing on them with the very ECB, at a negative interest rate of -50bp mind you, as either they are don’t see fit to lend the money out to the economy due to tight regulatory burdens, or this economy the ECB is supposed to preside over simply has no demand for additional funds. Talk about a perfect quagmire…

Well, it obviously doesn’t stop there. The punitive nature of the ECB deposits increasingly forces the banks to lay off the burden and charge negative rates on their customer deposits as well. And the biggest sufferers there are clearly the German banks, as their government bond market equally trades in deeply negative rate territory. So, how to make money, or rather, how not to lose too much on negative interest?

The Bundesbank reports that 77% of all company and 42% of all private customer deposits are already being penalised. In other words, those enterprises parking cash, as well as diligent individual savers, run a considerable cost just holding their money in cash. Tesla doesn’t even have the problem of being charged on any of their dollar deposits, and their management has already resorted to employing their cash balance by speculating with Bitcoin. Hmm.

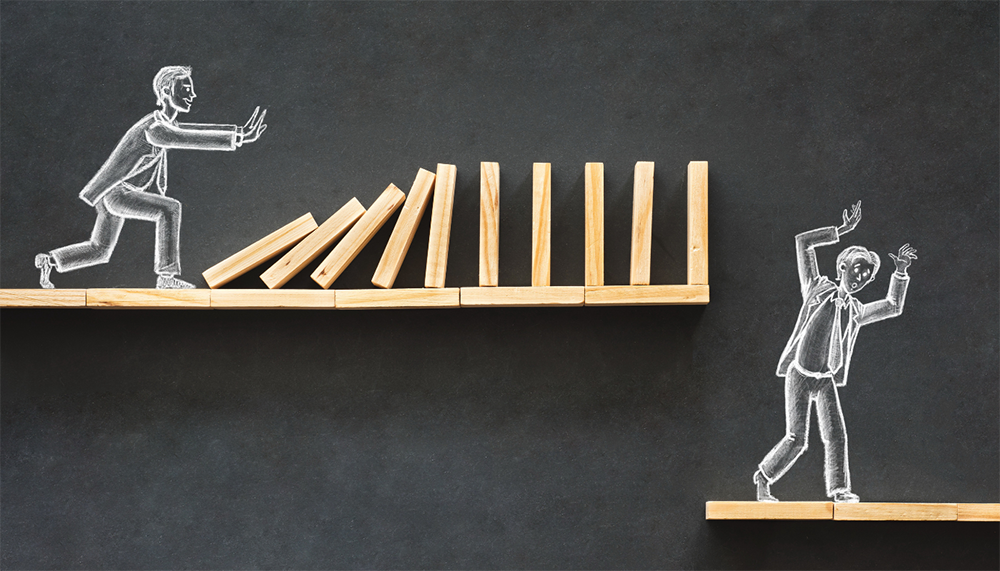

The ECB’s monetary policy is probably well-meant and geared toward throwing a continuous lifeline to the peripheral countries, but something always has to give. It has triggered a massive disequilibrium, one that feels like a domino effect at the apparent expense of the German taxpayer. Again, they may be a patient bunch and so far rather muted considering they are being taken to the cleaners, but you would think that at one point some sort of great awakening will set in.

At such point at the latest, the German government will no longer be able to gild the blatant injustice, for the mere purpose of playing the good European party hack, and be forced to act.