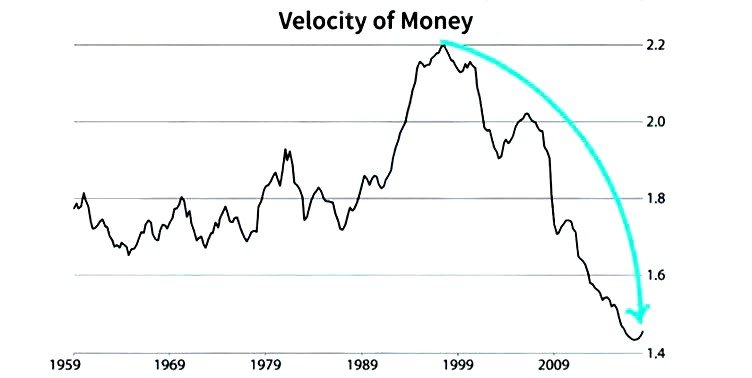

The velocity of money, a key measure of how effectively fiat currencies work as means of transactions enabling economic growth, has been declining across the past two decades, more or less hit rock-bottom in the wake of the financial crisis, and then was just flushed down the proverbial toilet amid the health crisis last year. An already ailing money velocity got the death knell when governments locked down most of the Western world’s economies.

To give ourselves a better sense, in America the Nominal GDP/ M2 declined from around 2.2 times at the turn of the century to 1.8 in 2009 and collapsed to a level of 1.1 in 2020. The eurozone already commenced at a significantly lower ratio of 1.7 times, dropped to approx. 1.2 when the financial crisis broke and has lingered inside 0.9 last year. Worse still is Japan whose ratio was inside 1x 20 years ago, dropped to 0.65, and broke through 0.5 in 2020.

What a testament to global monetary policies’ inefficacies…! America and Europe have truly little to show for after a decade of printing away money, and Japan even less so after 2 1/2 decades. No wonder that we have had this deflationary environment haunting us throughout this era. Unless the pundits are right and the Western economies come roaring back from the pandemic, V-shape and all, there will be no way to put the system back onto an inflationary path.

But where did all the newly minted funds go if not the economy? A recent

analysis by Bank of America Global Rates Research dubbed the ‘most important chart’ to look at, is confirming what we have sort of known all along. It depicts the central bank balance sheets of America, China, Japan, and the eurozone combined against the S&P index and calculates a correlation of 0.94 since 2009. Not bad, and how obviously in tandem the move has been.

In other words, excess liquidity of a total of 31.4 trillion dollars has produced only one main beneficiary, and that is the stock market. On top of this, BofA estimates another 3 trillion of balance sheet additions to be on the way and charts further correlated rises in the indices. To be sure, history doesn’t necessarily repeat itself easily, but it usually rhymes. BofA’s guess of how much more money printing there will be in 2021 is as good as anyone’s, but they will probably not be completely wrong.

So, there are few aspects to be watched closely. One, has BofA delivered another voice to something people have been suspecting, namely that despite all the Cassandras calling for an end to the bull market as well as an impending crash, above all the legendary Jeremy Grantham, this time will indeed be different and an unprecedented creation of money lift asset prices ever higher, notwithstanding occasional corrections that may feel like little earthquakes?

This almost requires that the recovery not be as powerful as pundits expect and the lion share of the excess liquidity to keep sloshing around the financial system. However, if the Biden administration managed to ignite the mother of all economic rebounds that, for the first time in a decade, redirected funds into the real economy where they admittedly belong, a massive reaction regarding astronomical growth rates and a jolt in inflation would be very possible, and equities might be missing out.

In the latter scenario, we would at a minimum be faced with a jump in long yields, and it would feel like a tightrope walk between economic bounce, rise in inflation, and the magnitude of the Treasury sell-off. If the economy overheated and inflation blew out, the Weimar aficionados would certainly have their day in the sun and the Fed be thrown into the conundrum of catching that falling knife. If rates rose too much too fast, on the other hand, the recovery could end up being a still-born baby.

But is it possible that, no matter what scenario prevails, in the words of ARK Invest’s Cathie Wood innovation will inevitably prevail and newer and newer economy leaders over-compensate any short-term inflationary bouts and a downturn in incumbent stocks? Be reminded, for example, that Tesla has outstripped every major car company on the planet and is now worth more than all of them combined. Also, did you see PayPal exceeding Mastercard’s market capitalisation this week?

And isn’t Bitcoin’s value of 1 trillion now bigger than Tesla’s? The revolution seems to be eating its children already. Hasn’t Elon Musk himself just promoted Bitcoin and caused the crypto to even exceed his own company? This is where the Grantham’s of this world may well err. As opposed to historical evidence, the new world is given distinction by sheer never-ending money creation as well as an unprecedented acceleration of technological advances that have indeed been changing our landscape.