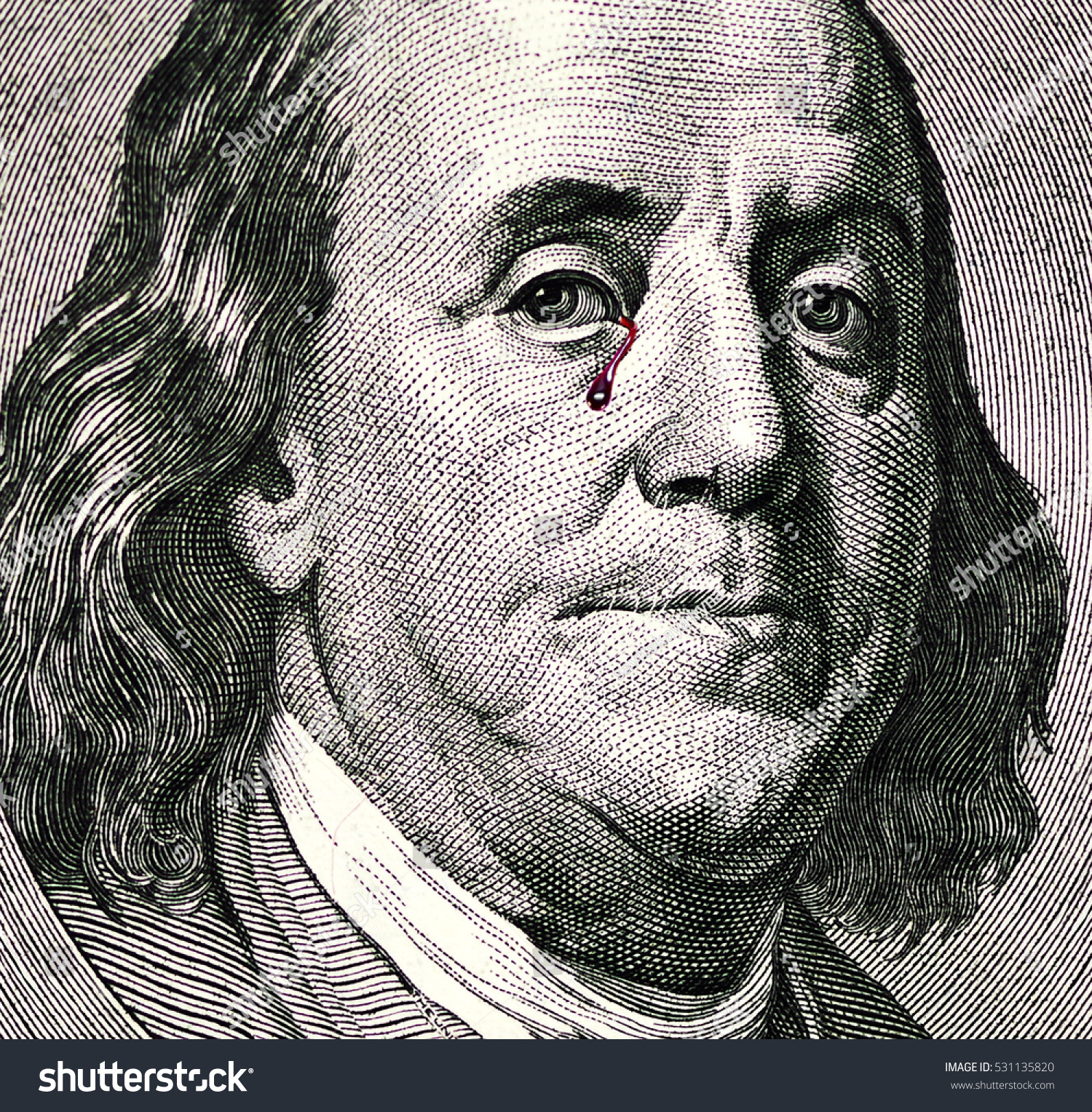

The dollar has taken a big blow in the past two trading sessions. The DXY index, the basket against major world currencies, dropped by an instant and easy full percentage point, to 91, spectacularly confirming the technical breakdown from and through the August lows. Commensurately, the Euro as the dominant weight in the index made new highs since early 2018 and is firmly on course to reach 1.25 in coming weeks.

There were a number of factors that finally caused the break of last resistance, and I have led on to this in a recent

post. Fed chair Jay Powell arrestingly voiced his view in front of the Senate Banking Committee that the rise in Covid cases was concerning and likely to prove challenging in the next few months. His warning of significant uncertainties seemed to eradicate the upbeat series of vaccine news clips and to be designed to prepare America for a dire period before it was to get any better.

Secondly, Joe Biden introduced his economic team on Tuesday, and apart from presenting the most diverse group of people in history, it turned out to be the most dovish on average. We have known about the appointment of Janet Yellen as Treasury secretary who by way of specialisation will predominantly have her eyes on the labour and wage markets. She said as much when emphasising deeper structural problems like wage stagnation and a disproportionate impact of the crisis on the most vulnerable.

Neera Tanden, a Clinton confidante and the new OMB director, remembered her time spent in public housing and called it an honour to help shape social programs. Adewale Adeyemo, president of the Obama Foundation according to his LinkedIn, as the new deputy to Yellen said the economy should be geared toward giving people a shot. And Cecilia Rouse, a dean at Princeton and prospective chair of economic advisors, also emphasised her research on unemployment and federal worker protection.

Biden summarised the introduction with a “help is on the way” diction. To be sure, it’s not that America doesn’t need all hands on deck when it comes to labour issues and the currently desolate state of employment. But it also gives us a hint on where the journey is likely to take us. The recovery for everybody, as Biden put it, will cost gazillions. Powell has previously re-iterated that the US system will probably have to rely on federal subsidies a while longer, an understatement of sorts.

Back to the dollar that is smelling the cake here. The much-touted economic recovery is already as good as history. From consumer spending to initial claim numbers, everything is pointing toward another recession in the making. The surge in Covid infections post-Thanksgiving travel will cause various forms of shutdowns to be imposed again. America needs help, and fast. And the fabric of Biden’s new economic team looks promising regarding generous stimulus action.

Even if there was a spilt in Congress and Biden had a hard time to push his stimulus measures through, the next administration will certainly take a cue from Donald Trump and try to complement congressionally passed bills by imposing presidential executive orders as much as possible. Powell will gladly stand by with his monetary sprinkler system hoping that finally, a more incremental portion of his newly minted funds will reach the real economy.

Thirdly, there happen to be those rumblings about inflation expectations to be picking up. Some pundits use this as an argument for their dollar estimates to be revised down and for long Treasury yields to climb. I wouldn’t be so sure. The inflation monster has reared its ugly head a million times in the past 10 years, to no avail whatsoever. What people still don’t seem to grasp is that the gargantuan monetary inflation does not necessarily lead to goods price inflation.

To be sure, if Biden and Powell were to channel all excess liquidity to-be-created into the real economy, ie infrastructure program after infrastructure program, then underlying inflation had a chance to tick up. But this is a long way to go. Employment gains by building airports, bridges and charging stations do not imply wage gains, and demographics and technological advances will keep a firm grip on price rises. Don’t be tempted to short the long end of a Powell-controlled curve, just don’t…

Apart from DXY and the Euro, Asia’s currencies are well appreciating against the dollar, and more of that will be in store. I have talked about this space’s bullish stance on Renminbi ad nauseam, and we seem to be on the verge of breaking higher yet again. But the material disconnect between Asian and Western growth scenarios has had the likes of Korean Won and Thai Baht gain ground as well. Further divergence in economic performance will only fuel that trend.

So, there you have it…! The new government will spend until the cows come home. That much is official now when looking at Biden’s team. The Fed will print ever more money and expand its balance sheet by many more trillions. That much is obvious. And the annual budget deficit, which stands at approx. 15% currently, will linger there for some time to come. That much is unavoidable. Considering all this, why would the dollar not be sold?