A lot has been made of the recent rebound in long Treasury yields. Admittedly, the 10-year bounced back to 72.5bp, and the 30-year bore the brunt of a weak auction and ended up at near 1.45%. According to the mainstream pundits, the path was finally cleared for yields for go up further and normalise, or so they would have put it. Well, nothing of that sort is happened, in fact, and the sad picture of the bond bears getting it on the chin is in the process of producing yet another sequel.

The bad auction certainly didn’t help and served as a bit of a trigger for yields to spiral up if you can call such minuscule moves that. There was a disappointment as much as fear-mongering that shook out excess long positioning. Actually, it may well have been a healthy correction supporting the concept of the bull market for longer. Lower bond prices were evidently seen as a great chance to increase exposure to be long the rates market.

Rates have since eased off again, only shortly interrupted by the release of the FOMC minutes last night, and the movement looks more like another bear trap if anything. To be sure, growth expectations have become more optimistic, but how much more pessimistic can one get after the Q2 numbers? Fact, however, remains that fundamentals are far from where they should be, and the next Covid-wave blasting across America’s south and California, in particular, will leave its scars well into Q3.

Also, there has been the chatter around goods’ price inflation to return after the Fed injected another 3 trillion of excess liquidity in the space of months and outdid itself with regards to creating monetary inflation. The inflation expectation numbers, however, give us no indication at all that such a development would be on the horizon. Demand is hard to come by in the wake of the health crisis, so what is to drive inflation, to begin with. Concerns about stagflation are equally unfounded.

Apart from these factors that have remained kind of unchanged, there are shock risks that the market apparently wants to price in to some extent. Sky-high equities may correct sharply at any given point in coming weeks or months, and we have learned in March what this means. A run on the stock market amid perceived economic stability risk would be conducive to further gains in bonds and probably be favourable in terms of a rebound in the dollar that is technically massively oversold.

And what we can also not forget about are the uncertainties around the election process. Do we think that bonds would sell off if Donald Trump contested a Biden win or a close result for that matter, potentially in an even prolonged fashion? Of course not. They would rally, particularly the long end. In other words, except for the raucous noise of the perennial bond bears, all signs still point to a constructive rate market for the time being.

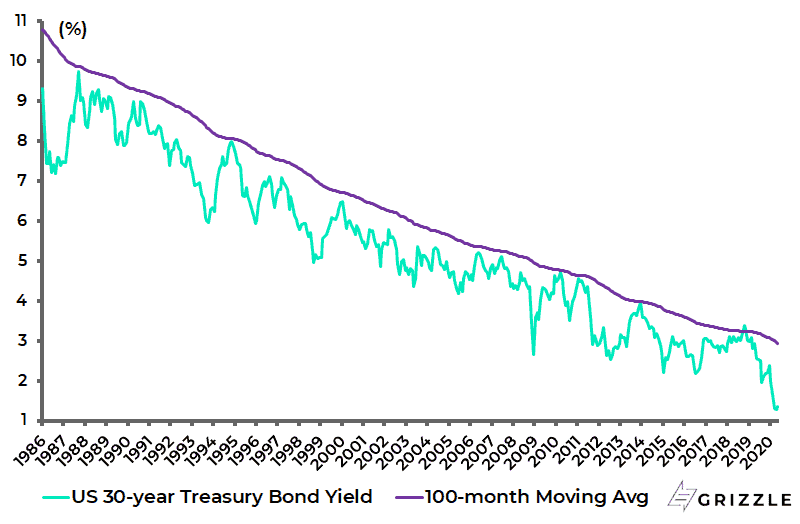

So, the longer-term trend remains the investors’ friend here. We can expect 10-year rates to test the 50bp threshold again in due course, and the 30-year the 1%.