Quite impressive with regards to a stock market rebound we have seen so far this week. Well, at the same time it probably had to happen at one point, even if it was just to cover a portion of all those short positions out there. But the real question is whether this is anything to build on again. The health crisis is not letting up, by any measure, and the dislocation across all asset classes has been so severe that a few good days in stocks will not do it.

Despite the unprecedented announcement by the Fed to become a backstop for all bonds except high yield, we haven’t seen a dramatic improvement in fixed income markets. Commercial paper is still jittery and spreads nowhere near where they should be, ie even the best companies have difficulties to tap the market. Municipal bonds rallied back from their lows, but the performance among states is incoherent at best. And mortgage spreads to Treasuries have been all over the place, to say the least.

Equally, most crisis indicators are still on red alert. The gold price has eclipsed the 1,600 dollars per ounce threshold again. Long Treasury yields remain subdued for risk factors more so than Fed buying. And volatility has given everything else but an all-clear. The VIX index had hit 2008/09 highs of 85 points last week. It plunged at the start of Tuesday’s trading in the wake of the equity bounce, but it eventually closed the session back up at a distressing level of the mid-60s.

In addition, the world has still not quite woken up to the dangers of the prevailing dollar shortage offshore. I’d like to again refer to last week’s

post. Despite the Fed laying out new swap lines with other central banks, it has become painfully more expensive for foreigners to raise dollar liabilities to hedge their dollar-denominated risk positions. The basis cost in the swap market has still not moderated much. The Fed would have to massively increase those to alleviate the burden.

If Powell & Co were to dither on this, the selling pressure on gargantuan amounts of dollar-denominated assets overseas would almost certainly not dissipate. There is still a lot to be done to mitigate the tectonic destruction of the health crisis and the oil price plunge have caused. The Fed and other central banks better address these and align their policies painstakingly to make the rebound more sustainable.

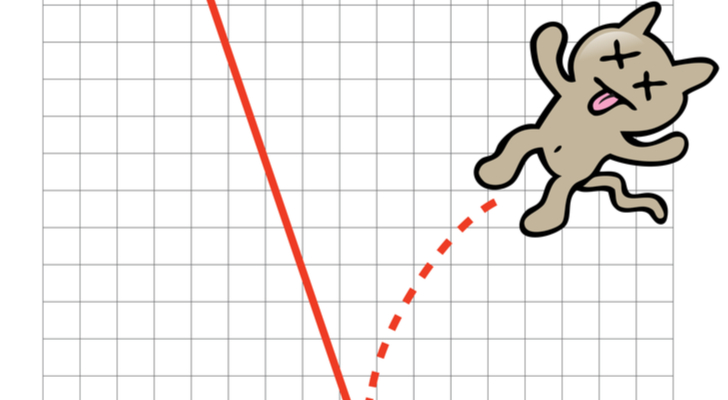

This is not for the purpose of scaring anyone, but let’s all collectively be aware… The ghosts of the 1930s are rearing their ugly heads. As someone shared with me, we could be right in the middle of the 1929 playbook. Then, the Dow Jones crashed by 40% initially, to quickly rebound by 20% and re-crash by another 30%. The index subsequently consolidated into the early 1930s before commencing a 2-year bear market through the Great Depression leaving a mere 20% of its value in 1932.

Policymakers beware, as the pattern looks ominously similar now. The S&P crashed 35%, to 2,200. A rebound of 20% would lift it back up to 2,600. A potential subsequent drop of 30% from there, like in 1929, would get us to a value of below 1,900! Any further extrapolations of what happened during the 1930-32 period would be too painful to even contemplate and bordering on the absurd. The time to act is now, as is the time to find the right

balance between health scare and economic consequences imperative.