On many occasions, I have reminded our readers of this non-sensical China trashing last year. From credit implosion to currency dumping to reserve meltdown, the mainstream media had it all for you a silver platter. Even the smartest minds on Wall Street shivered in their pants, before a collapse of the second largest economy in the world that never happened.

You don’t hear so much about it now, do you? The one or the other Cassandra is still periodically calling for an allegedly inevitable crash to come, but in the end, the blabber finally deflagrated. China is perfectly on track to deliver its growth targets for the year, maybe even overshoot them, the speculative attack on its currency has been averted, and the transition from export- to domestic consumption-led economy is in full gear.

To be sure, the Renminbi weakness into early this year was not to be taken lightly. It cost the PBoC the better part of a trillion dollars to fend it off. This space has however argued that the subsequent reduction of reserves from 4 to 3 trillion wasn’t really an issue. Why hold 4 trillion of reserves in the first place, if you are gradually bidding farewell to your emerging market-like export model and modernise your economy into a truly balanced construct?

For its purposes, China has no need for this magnitude of reserves. 3 trillion may still be too much, maybe even 2 trillion. In other words, there was never any doubt that Beijing could not fend off the ripples in its FX market by employing the firepower at its disposal. At the time, the professor friend was in touch with highest ranking officials and confirmed to me that the PBoC was certainly not losing sleep over it.

To label it as capital flight as the mainstream pundits were doing was simply wrong. It was mainly a function of the internationalisation of China’s economy that might have gone into overdrive for a while. Beijing quickly made sure that there was a mean reversion – benefits of a managed economy. Ever since, the currency has been stabilising again around the 6.50-6.60 versus the dollar range, appreciated from the lows of almost 7 at the end of 2016.

Correspondingly, China’s reserve pot has bottomed out and started growing again. As has been reported over the weekend, the allegedly ominous number has grown back to over 3.1 trillion dollars. No free fall to be seen anywhere, as the pundits had forecast only a few months ago. Even US Treasury holdings that were reduced markedly in 2016 have rebounded to 1.15 trillion, having China overtake Japan as the largest foreign owner of US bonds again.

To be fair, what needs to be kept in mind though is that the long-awaited 19th National Congress is opening next week, where Xi Jinping is expected to be reelected as the party’s general secretary. The potential for window dressing is minimal in any case, but at the same time Beijing officials will obviously leave nothing to chance and do everything for the event not to be disrupted by any volatility and spikes in macro or market numbers.

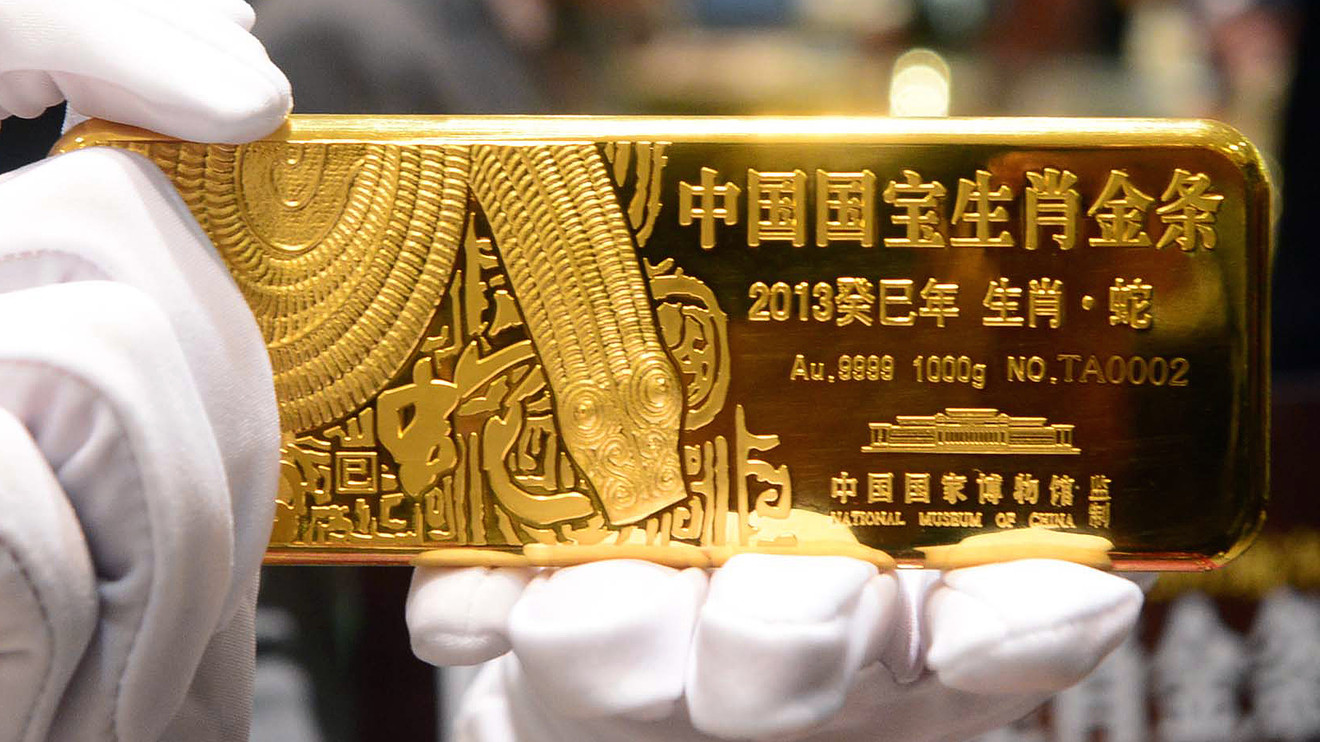

There has been one aspect that I have been highly critical of, however. For an economy the size of China, and still growing fast, its share of gold reserves are being dwarfed by almost every major country in the world. It is a rather poor statement. In September, gold holdings have even been reduced to below 2.5% of total reserves. Only Japan is on par or slightly below China’s ratio.

Leading the pack are the US at 75% and Germany at close to 70% of total reserves. Then there are other Europeans such as Italy, France and The Netherlands at over 60%. Russia is at 15%, and even India is higher at 6.3%. Granted, the absolute value of 76 billion dollars in gold is large, but it materially lags behind Germany’s for example that is closer to 120 billion.

There is clearly more to be done, particularly with regards to rebalancing the 1 trillion+ mountain of US Treasury paper wealth, and against the background of fiat currencies all over the world being monetarily inflated like there is no tomorrow.