Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

Rescue-the-banks is the quote of the week again in Italy. Sequentially, ailing banks, as in pretty much all the country’s banks with the potential exception of Intesa Sanpaolo, are being considered for bail-out monies. You will recall that Rome created this 20 billion Euro fund in December for the purpose of recapitalising its weakest lenders – never mind that all this principally goes against any EU treaty ever passed.

According to the FT a consideration of 5 billion is being made for two struggling regional banks, authorities calling it a precautionary recap in the context of a liquidity support scheme to bolster their balance sheets. Allegedly, it is the one mechanism, or should we say loophole, that allows eurozone countries to pump state money into banks without infringing state aid rules, despite the fact that those rules are obviously violated.

Same method of equity injection is about to be applied for the most ailing of them all, Monte dei Paschi di Siena, at the amount of 8.8 billion. It needs to be pointed out here that all this aid is being manufactured after attempts to raise private capital failed miserably. In effect, these banks are insolvent and being kept on a lifeline. In order to save the EU some face banks receiving this aid are required to submit restructuring plans to Brussels.

Fat chance for that to happen in a meaningful way! We just have to accept that the EU has become a laughing stock, and all this will not shoo away the reactionary populist wave that is ever more gripping the Old Continent. The next and largest problem case of them all is hanging in the wind already. Unicredito is reported to receive 13 billion by March. One must wonder how the math works, as those four alone already exceed the program size.

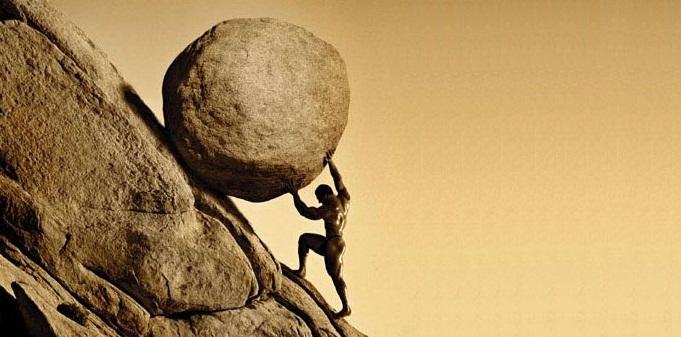

In any case, with all due respect to what well-meaning eurocrats and self-serving Italian authorities are trying to achieve here we are nothing short of pushing the rock up a hill. As the Banca d’Italia reported data on bad debt at Italian commercial banks this week, i.e. loans that are more than 90 days delinquent, the mountain of irrecoverable assets remains at record highs of in excess of 200 billion, 200.9 to be exact.

As a share of total private lending to households and enterprises the ratio holds at a record 12.3%. To give you a sense, in early 2009 this number was closer to 2.5%. Nothing whatsoever has been done over the past few years to tackle the problem. There is no bad bank set up for those loans to be shifted into. Essentially, the problem has been and is being rolled over.

And let’s be honest. The above liquidity support by the Italian government is nothing but a drop in the ocean. It will make sure that banks continue to operate at best, but nowhere near will it be sufficiently impactful to tackle the bad loan problem as such. In truth, it is merely a means to an end for the can to be kicked down the road for a little while longer.

As the fog lifts though, and the magnitude of Italy’s financial quagmire becomes increasingly transparent to the masses, we are facing new elections. A date hasn’t been confirmed yet, and the decision will most probably depend on where Holland and France come out. If the extremist parties can be constrained there, it will be likely and much easier for Italy to hit the polls some time in June.

I am not sure the establishment parties are doing themselves any favours by allowing Matteo Renzi to kick off a leadership contest within his centre-left party, as he announced this week. I, as much as the majority of the Italian people I guess, would have thought that he had accepted the consequences of his referendum loss and left it to others to articulate a strategy that prevents the country from drifting into the populist abyss.

This establishment better tread carefully. Increasing transparency of the country’s monetary swamp combined with politicians who failed but don’t know when to step down is a dangerous cocktail ahead of elections. We must not forget, a lot is at stake, for Italy and everybody else in the eurozone.

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.