Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

They were anxiously awaited, those new January data on China’s foreign currency reserves by the PBoC on Tuesday. And clearly, the mainstream media had its field day with them, as the total balance fell yet again, by -12.3 billion dollars compared to December, to a new low of 2.988 trillion. From its highest reading of 3.993 trillion in June 2014 the balance has now fallen a whopping 995 billion dollars.

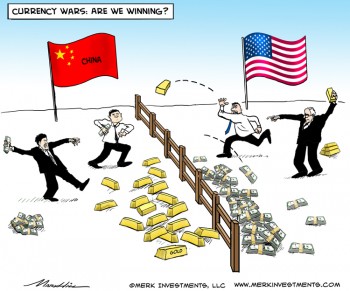

The fact that the symbolic mark of 3 trillion was broken on the down triggered quite a bit of malice from the Western world. Views such as China has finally lost control of its system, to the capital flight is accelerating, to the implosion of its economy is nigh, you could hear all the doomsday scenarios again over the past 36 hours. Well, what else to expect from the pundits who will never learn.

As I wrote in a widely read and commented on piece in January, so what if China had to continue supporting the Renminbi for a while longer? Chinese reserves have declined from its record of almost 4 to now just under 3 trillion. But despite the huge numbers involved, is that a real problem? A good source had been telling me then that the PBoC isn’t nervous about it. At least they aren’t running around like a headless chicken as the Western mainstream media would like to portray them.

To be sure, it doesn’t come in handy, but as pointed out before, a modernising and more domestically focussed China is simply in no need of holding 4 trillion dollars in reserves, nor does it need to hold 3 trillion, maybe not even 2 trillion is a healthy magnitude. In other words, China easily has enough firepower to keep its currency in check. And things will long have changed again by the time those excesses are used up, say in 12-24 month.

China is obviously interested in controlling the FX market, even if that meant having guided the Renminbi lower in a controlled manner. To manage the process effectively a whole lot of Treasury bonds have been shifted in past 6 months. Mind you though, those bonds were mostly sold at record high price levels, and the PBoC seems to believe we have seen the top of that market last summer in any case.

It is very likely that the next TIC data release later this month, for the month of December as there is always a 2 month time lag, will reflect a continuing selling of Treasuries by the Chinese. The November total was already down to 1.049 trillion dollars worth of paper, December probably was lower again, and when we get to see the January balance in late March, it may well give us the first number inside the 1 trillion mark.

There is no doubt that China’s net capital imports are history, as current capital outflows exceed the current account surplus. The question that is hard to answer however is whether it is primarily capital flight with has been driving the exchange rate, or whether it is an intentional reduction of dollar reserves such as US Treasuries, or whether it is a combination of both.

Why do I say this? It is noteworthy that the Renminbi has been resilient and actually strengthened from beginning of the year. Is the PBoC actually overdoing it, as in deviating from an intelligible course of controlled depreciation, or is it so keen to get rid of those US bonds as quickly as it can, regardless how strong or weak the Renminbi is? Looking at those currency moves one might wonder.

In any case, the US administration has nothing to complain about. Whatever China is doing, it certainly doesn’t categorise as a currency manipulator as per Washington’s definition. Either it is plagued by gargantuan capital flight, in which case it is diligently doing everything for its currency not to slide and remain stable. Or it somehow acts in its own interests with regards to foreign holdings, in which case it might even be driving its currency up.

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.