Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

TIC data time for the month of November, and please be reminded once more that they are being released with a 2 month time lag, which is we are fully aware backward-looking and not ideal. But we have to take them as they come. It is still important to understand where the flows of Treasury bonds have been and try to extrapolate current developments from there.

China is naturally the elephant in that room. Beijing has been reducing dollar assets by a substantial margin, which had by the way already been reflected in October’s TIC data when Treasury holdings were reduced to 1,116 trillion, by -150 billion year-on-year, and they fell below Japan’s holdings for the first time since 2008. Mainstream pundits trying to trash China have been all over this in recent months.

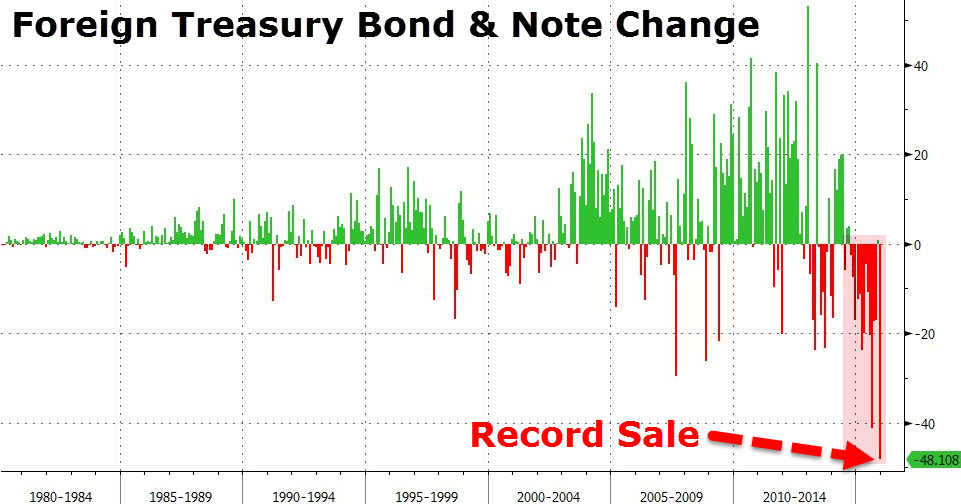

November wasn’t any different and continuing the trend. China dropped -66.4 billion from October and and an even bigger -215.2 billion year-on-year. Total US government bond holdings shrank to 1,049 trillion dollars, a massive -267.4 billion lower than at the 2013 record highs. Other foreign owners of Treasuries kept a fairly steady balance on average, but China made sure that total foreign holdings dropped by -96.1 billion to 5,944 trillion.

The reduction in China’s holdings obviously stems from a cocktail of cross border activities that spans from increased foreign direct investment to a degree of capital flight, something the PBoC has been taking seriously introducing measures to better control the outflow of funds. At the same time, those redeemed dollars are being employed to counteract the ongoing pressure on the Renminbi.

As I put in a post last week, so what if China had to continue supporting the Renminbi for a while longer? It is correct that Chinese total reserves have declined, from its record of 4 to 3 trillion. But despite the huge numbers involved, is that a real problem? I have it from a good source that the head of the PBoC isn’t exactly nervous about it. At least he isn’t running around like a headless chicken as the Western media would like to portray him.

It doesn’t come in handy, but one, a modernising and more domestically focussed China is simply in no need of holding 4 trillion dollars in reserves, nor does it need to hold 3 trillion, maybe not even 2 trillion is a healthy magnitude. In other words, China easily has another trillion if not more to spend in order to keep its currency in check. That’s not nothing, and times will long have changed again by the time those are used up, say in 12-24 months.

I also pointed out, there was another aspect to China holding fewer Treasuries in particular. As is widely known China keeps only 2% of its foreign reserves in gold, a ratio far below most countries in the Western world except for Japan, and even materially lower than places like India. The US’ is the largest share with 75%. China as I hear is much keener to push up its gold holding rather than be concerned about its Treasury position.

In any case, it all looks a bit different when making the effort of looking behind the curtains and listening to first-hand information. China seems to be going about their imbalances sensibly. In a very natural shift Treasuries are being sold on a net basis at record high prices, to both control the Renminbi and shift reserves into gold. And there are plenty of bonds left in those PBoC vaults.

But back to TIC. Even Japan registered a marginal decline in November, and it will be interesting to see how their positioning changes into the year end and early this year. We can well assume that Abe has made his deal with Trump, as pointed out in a late November post, on many fronts. One might well be that Japan will support financing the prevailing US current account deficit.

10 year JGB rates are being kept at zero, no matter how many Yen the BoJ has to print. If Abe and Kuroda continue this policy, they will achieve two things: One, the Yen will decline further, which is a crucial increment of Abenomics. To remind readers, this space’s ultimate target remains 150 against the dollar. And two, by artificially widening the rate differential Japanese funds will keep flowing into the dollar, also into Treasuries.

The most prominent net purchases visible in November’s TIC came from Ireland yet again, a jurisdiction that traditionally houses massive pockets of cash deposits and short-term bond holdings for US corporates. Not to forget Russia, which after significant reductions in 2012 through 2015 has been rebuilding reserves and stocking up on Treasury bonds again. In aggregate however, these haven’t moved the needle much.

There is quite some rebalancing going on within the portfolio of foreign owners of Treasuries. We can assume that the TIC data for December and January will tell us that China’s bond holdings are further on the decline, as in above’s context. Japan I reckon is remaining stable or even increase as we speak and going forward. The rest will not matter all too much, but on balance foreigner are probably holding fewer bonds.

There is lots of speculation that the Fed sitting on almost 2.5 trillion of those Treasuries will soon commence to unwind its portfolio. I doubt that. Against the background of the current volatility in the rates market and those much more material shifts among foreign holders, why would a Fed under a dove Yellen think now would be the right time to pour oil on the fire?

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.