Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

The proof will be in the pudding, as it always is. OPEC may claim to have agreed an exceptional landmark deal to cut output on Wednesday last week, what it means however no one can be sure of. In any case, if you look at the numbers, the reduction of 700,000 barrels per day comes across as minuscule at best. And the question remains whether we have yet a leg to stand on with regards to implementation of that deal.

To be sure, the market largely celebrated the negotiated outcome and the first OPEC deal in 8 years. Crude jumped from a 44 handle to over 48 dollars per barrel, and the resource-related risk markets have taken a bit of a breather again. We are still not anywhere near the June highs of almost 52 dollars though, and the initial hype is about to be fading away a little as we go on in the new week.

The devil, and we don’t need to be reminded of it, is in detail however. While a new total OPEC output range appears to have been agreed upon, it has not been decided how much each country will eventually produce. The crux of the matter clearly lies therein. For the sake of not ending in another failed meeting and having at least something to show for, the answer to this question was pushed out to the next meeting to be held in November.

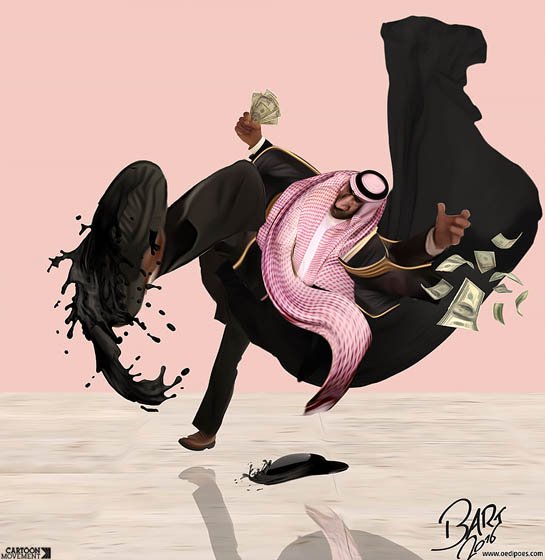

So, what happened? Well, it looks like Saudi Arabia blinked first, and another round of negotiations went to the Iranians. Iran has been under sanctions for so long, and it is hard to believe they can be told to constrain their production now. Too much catching up there is to be done by Tehran to get the country’s economy going again. And no one has heard the Iranian oil minister say yet that he will not go back to pre-sanction output levels.

Saudi Arabia’s ultimate objective on the other hand is to finally pull some floor under oil prices in order to stabilise their budget situation. The country is running a deficit of roughly 15%, or almost 100 billion in 2015, and is bleeding reserves. They have already burnt through about 200 billion dollars of foreign exchange from the peak of just under 750 billion in summer 2014 to subsidise the gargantuan budget shortfall. But things are only getting worse.

Riyadh is sitting on a social pressure cooker. The most recent desperate act was to cut public salaries by up to 20%. Initiatives to modernise the country and diversify away from its grave oil dependency are blossoming up, but it may be too little, too late. The pain is only to spread from here, and the government has a mammoth task on its hand to steer that ship cautiously and skilfully. Domestic uncertainty is the last thing Saudi Arabia needs right now.

It is against this background that in the negotiation with predominantly Iran the Kingdom currently holds the shorter end of the stick. The OPEC deal last week can merely be seen as a form of progress in communication terms, but in reality Iran has given in on literally nothing. The can has only been kicked down the road, that is to say to November. Whether a resolution can be found then should be doubtful.

Saudi markets are highly nervous for good reasons. The broader stock market has entirely decoupled from the oil price and is back down to its Arab Spring lows, and banks trade in Lehman implosion territory. As a reflection of that Saudi interbank rates have spiked to levels not seen since the height of the financial crisis. And for the first time since the February lows in crude we are seeing the Saudi Riyal’s peg to the dollar wobble again.

This space had commented on a potential de-peg in January and again in April. On Thursday and Friday the spot market had a go at it, albeit unsuccessful, but the forward market is already pricing in a massive devaluation down the line. Such a scenario can still not be underestimated. Were the Saudis pushed against the wall in November, with Iran making no compromises on their output, last week’s so-called deal would collapse quickly.

What then…? Well, there is a proverbial nuclear card that the Riyadh rulers could still play. If OPEC, including Russia, cannot find a common way to control production, why control it in the first place? Why not de-peg the Riyal, increase production unilaterally and link the currency to a declining oil price? Russia has done it, and reasonably successfully. In Ruble terms Russia always made equal amounts of money from a barrel, whether at 120 or below 30 dollars.

In light of looming inflation in line with such strategy, and the fact that Saudi Arabia is more dependent on imports than others, the pundits say its rulers want to avoid the de-peg at all cost. They have a point, but the question is one of what is the lesser evil. At least it would be a short-term fix and buy valuable time. The other question however is one of whether there will be knock-on effects beyond the Saudi borders.

We cannot know for sure, but a de-peg would mean that Riyadh was pretty much giving up on OPEC. Crude prices could take a massive hit and then continue to go lower still. The remaining pegged resource currencies would all de-peg from the dollar, and potentially the mother of all rat races to the bottom ensue.

I have it from a first hand source that the current US administration doesn’t seem to be concerned about a Riyal de-peg and thinks that it is exclusively a matter of Saudi decision-making. I find that surprising, as letting the currency float might be like opening pandora’s box, with the world staring into the abyss of yet another known unknown.

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.