Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

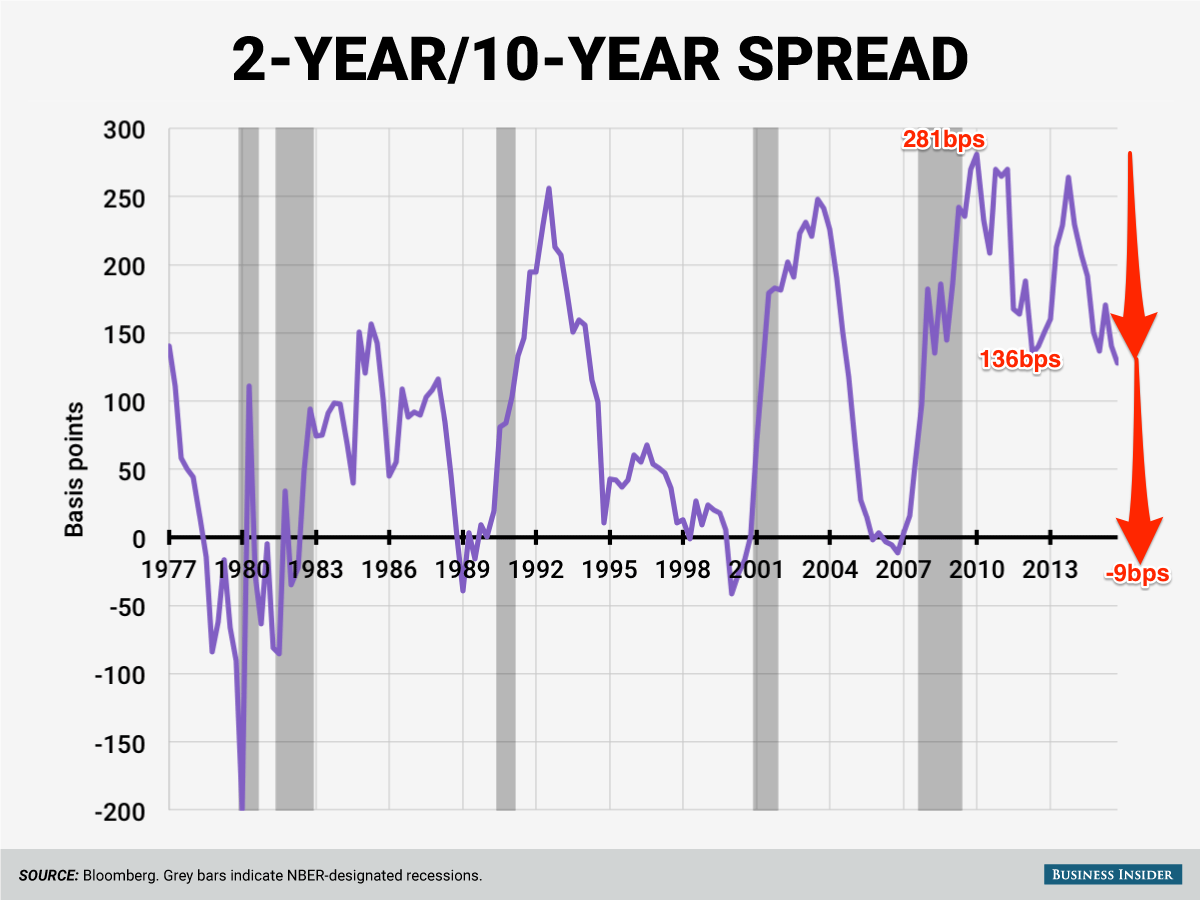

It is nonsense you might think, to even contemplate an inverted yield curve in the Treasury market, i.e. 10 year bond yields trading below 2 years. Fed funds are still near zero, and 10 year rates are pretty much the highest the developed world sports currently. But you know what…? Never say never. It’s happened twice already during this still short century, such as in the early 2000s when the tech bubble burst and then again just ahead of the financial crisis.

Inverted curves are generally a reliable indication for recessions to come. We are obviously still maintaining a positively shaped Treasury curve, but you will have noticed that the differential between 2s and 10s is shrinking very steadily. We are currently holding at a level of 82bp, which is the lowest since 2007. Only in 2014 10 year rates were around 270bp higher than 2 years, and exactly 12 months ago the spread was 175bp.

So we have indeed come a long way, and if you look at the long-term chart going back to the 1980s, you will detect an oscillating pattern that had the differential move between slightly negative in the lows and just shy of 300bp on the highs. We are now in one of those downward trends, and if it continued, history would be telling us about a potentially massive recession lurking around the corner going into 2017/18.

How would we end up in a negative territory? Well, long bonds needed to rally further, which is the view of this space in any case, and the short end had to suffer distortions that would drive 2 year rates up. Is this so implausible? I don’t think so. 2 year Treasuries have had a rocky ride amid the confusion about zig-zagging policy views the Fed is continuously causing, not least again overnight in the release of the July Fed minutes.

If 10 year rates move to 1% as envisaged, and 2 year rates spike to 1% or above which we have already witnessed at the turn of the year, we will for the first time since 2007 have an inverted yield curve again. Of course the 2 previous inversions century-to-date were on the basis of much higher absolute rates. Does this matter? No, as we have heard from the Fed’s own John Williams that the natural rate of interest is lower and likely to trend even lower.

The recession-forecasting mechanism should be the same. Maybe the Fed is also sensing what’s to come and for that reason looking for those non-orthodox measures to combat a suspected downturn to come. So if the trend of a declining rate differential continues and serves as the harbinger of a 2017 recession, only massive and unprecedented measures, both monetary and fiscal, could prevent it from happening.

In such a scenario, the Fed couldn’t hike rates quickly enough to have ammunition to counter a recession by lowering them again, quickly enough. On the contrary, raising rates would only speed up the yield conversion and pour oil in the fire of an already prevailing economic weakness. That’s what Williams was getting to I believe. The Fed has run out of capacity to stem the tide alone, and politics is being drafted to get ready to help in a concerted action.

What breaking the orthodoxy means we cannot yet know, but we can assume that it would include easing on an unprecedented scale. Nominal GDP targeting was mentioned for example. I can’t remember the last time that term had been played with publicly, but I am pretty sure it must have been at the height of the crisis. If it is being used now, then one needs to wonder what the Fed is anticipating to happen.

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.